nassau county property tax rate 2021

The New York state sales tax rate is currently 4. We provided the 2021 estimated values to the taxing authorities on May 28th so they can begin their budget process using these preliminary figures.

Nassau County Board Of Commission Approves Tentative Millage Rate On 4 1 Vote Fernandina Observer

20222023 Tentative Assessment Rolls.

. Explore how Nassau County applies its real estate taxes with this thorough review. If you are able please utilize our online application to file for homestead exemption. Nassau County New York.

As part of a 35 billion county budget for next year Curran has proposed a 70 million property. Wont my property taxes go down if my assessment goes down. A year later it was 600000 a 143 percent increase.

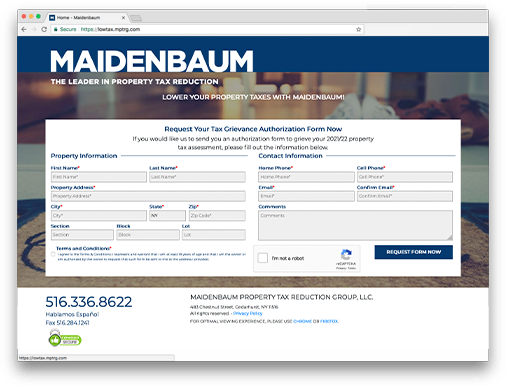

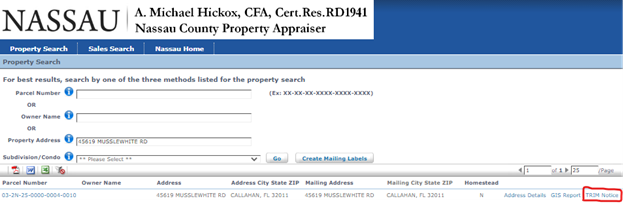

I would encourage you to participate in this process. In Nassau you file with the Assessment Review Commission and the deadline is March 1 2021. Look Up an Address in Your County Today.

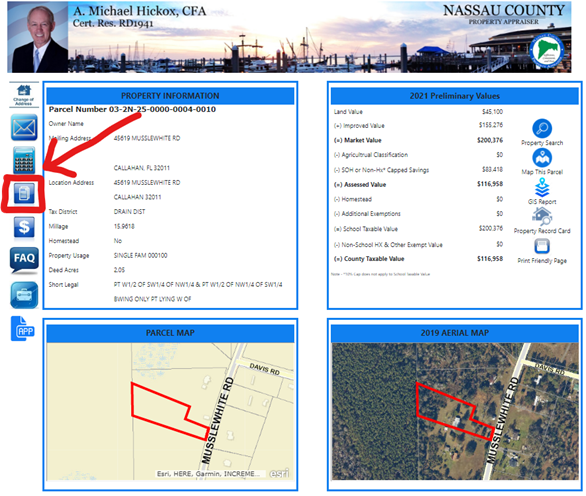

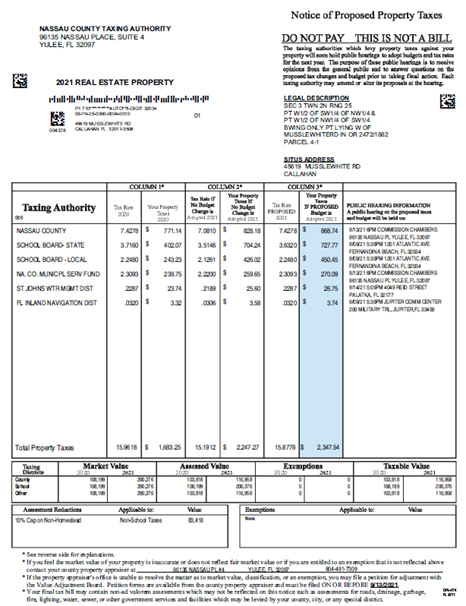

The Land Records Viewer allows access to almost all information maintained by the Department of Assessment including assessment roll data district information tax maps property photographs past taxes tax rates exemptions with amounts and comparable sales. In November of 2019 the median pending sale price for a residential condominium or co-op property was 525000. Michael Hickox made the below post on the departments FaceBook page providing valuable information related to the Truth in Millage TRIM notices that was mailed to property owners on August 19th.

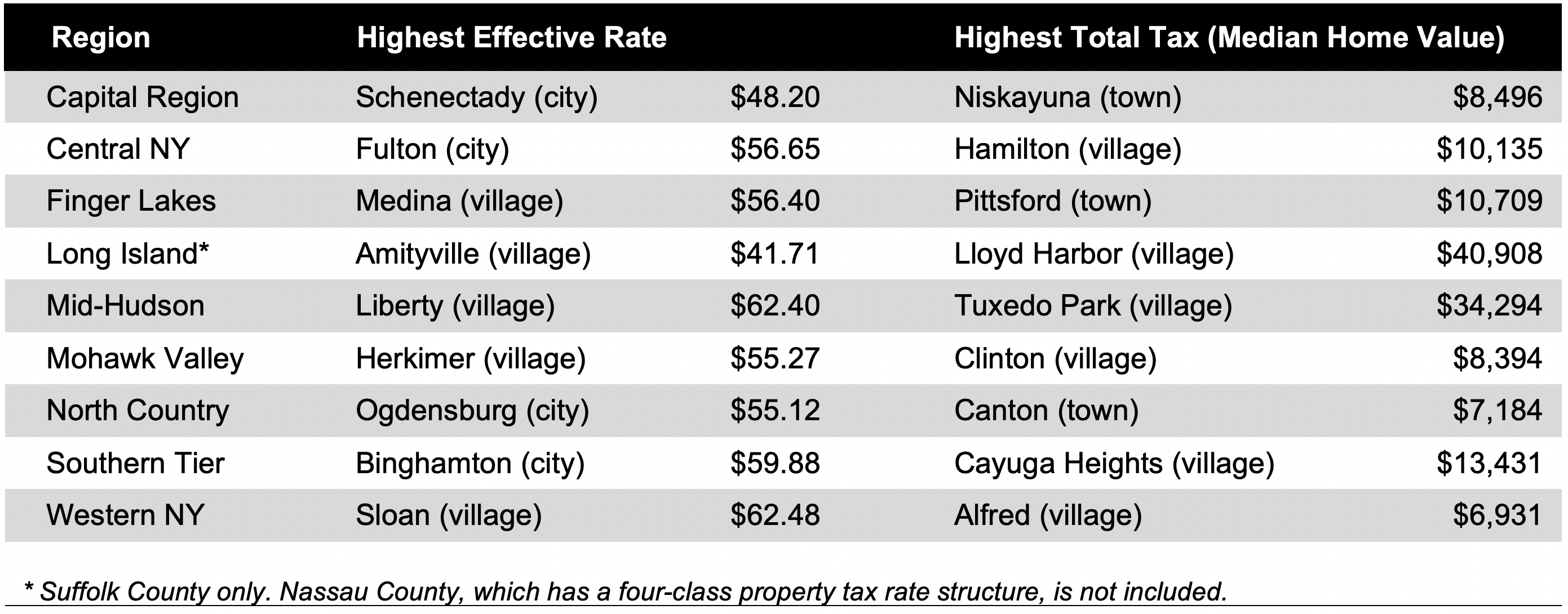

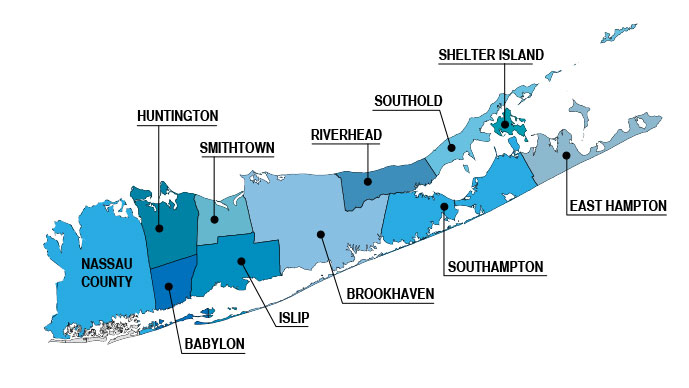

August 24 2021 82321 400 pm. Across Nassau County residential property values increased by 119 percent in the same time period. Municipal tax rates range from 003 to 1805 per 1000 of full market value depending on the town and village.

Commercial Real Estate residential real estate miami beach Real Estate Lawsuits Development ACRE033 AMT107 COLD019. How are Long Island taxes calculated. If you have any questions his office can be reached at 904 491-7300.

Tax Records for Local Properties Have Been Digitized. Suffolk County is a fraction more expensive clocking in at an average of 23 of the assessed fair market value. Learn all about Nassau County real estate tax.

Whether you are already a resident or just considering moving to Nassau County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Processing applications for property tax exemption and the Basic and Enhanced STAR programs for qualifying Nassau County homeowners. 179 of home value Yearly median tax in Nassau County The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900.

The tax reassessment affects 400000 residential and commercial properties in Nassau County. Nassau County Property Tax Reassessment Takes Some By Surprise Trending. The New York state sales tax rate is currently 4.

20212022 Final Assessment Rolls. The median property tax also known as real estate tax in Nassau County is 871100 per year based on a median home value of 48790000 and a median effective property tax rate of 179 of property value. Rules of Procedure PDF Information for Property Owners.

The Nassau County sales tax rate is 425. Sears seat switch s20952 schlitz beer mirror value nucore vs lifeproof. How to Challenge Your Assessment.

This is the total of state and county sales tax rates. Counties in Florida collect an average of 097 of a propertys assesed fair market value as property tax per year. Nassau County collects very high property taxes and is among the top 25 of counties in the.

Seven weeks ahead of election day Nassau County Executive Laura Curran is offering voters a deal. The deadline to file is March 1 2022. Nassau County Property Appraiser A.

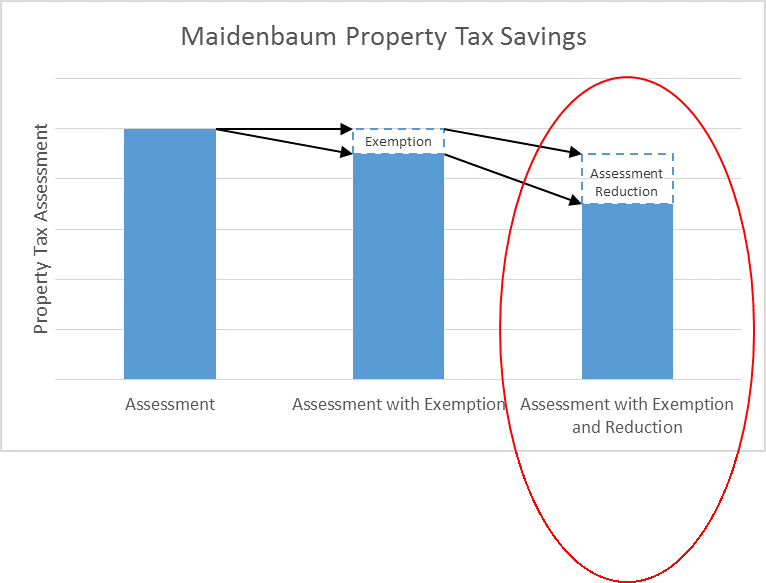

Based on the CPI used for 2021 previously homesteaded properties will see their assessed value increase no more than 14 this year. Nassau County Homeowners Are Grieving and Winning Reductions in Their Property Taxes New statistics released by the Nassau County Legislature report that some 219780 Nassau County homeowners filed property tax grievances during the current tax year. 109606 of these grievers about 50 percent received reductions on their property tax.

Ad Request Full and Updated Property Records. Remember you can only file once per year. We provided the 2021 estimated values to the taxing authorities on May 28th so they can begin their budget process using these preliminary figures.

Look Up a Home Now. Cobra charges only 40 of the tax reduction secured through the assessment reduction. In Nassau County you can expect to pay an average of 224 of your homes assessed fair market value.

Nassau County New York Property Tax Go To Different County 871100 Avg. Nassau County Tax Lien Sale. The Nassau County sales tax rate is 425.

Florida is ranked number twenty three out of the fifty states in order of the average amount of property taxes collected. It is also linked to the Countys Geographic Information System GIS to provide. In Suffolk residents file with the town in which they reside and the deadline is May 18 2021.

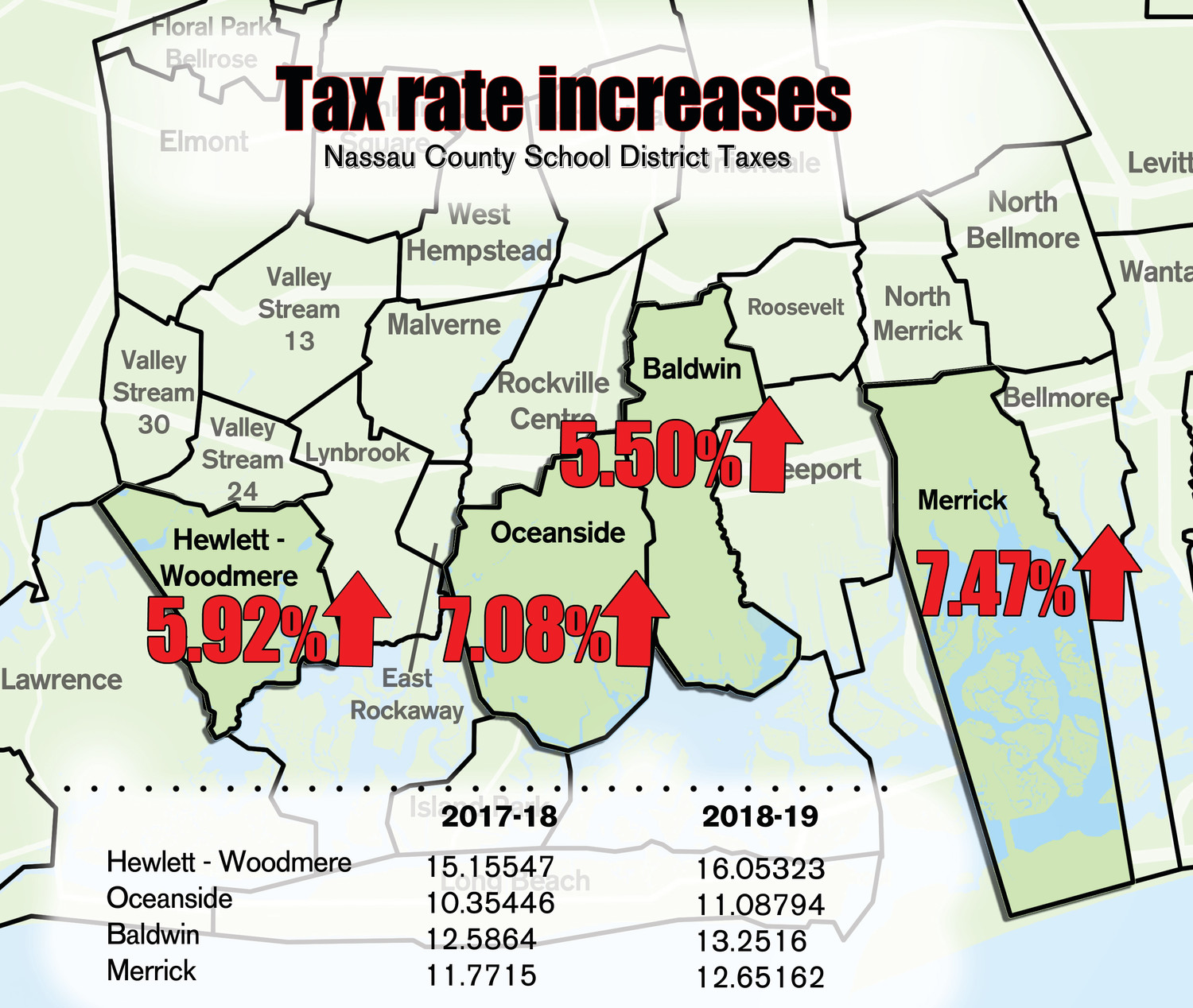

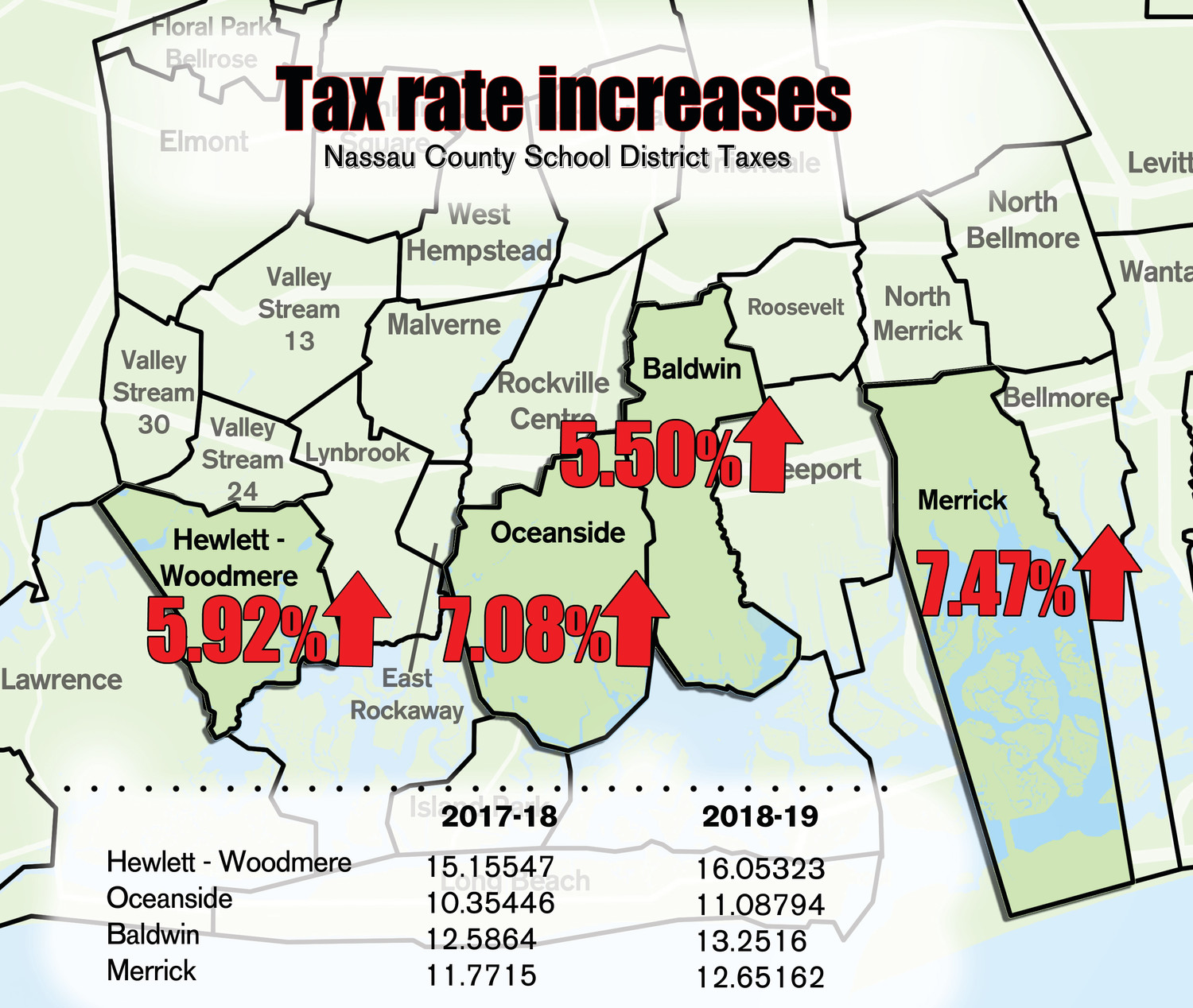

These higher taxes reflect rising property values. 4 discount if paid in the month of November 3 discount if paid in the month of December 2 discount if paid in the month of January 1 discount if paid in the month of February Full amount if paid in the month of March no discount applied The full amount is due by March 31st and if not paid becomes delinquent on April 1st Payment Options. Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863.

Nassau County Property Appraiser. This is the total of state and county sales tax rates. The median property tax also known as real estate tax in Nassau County is 157200 per year based on a median home value of 21360000 and a median effective property tax rate of 074 of property value.

Nonhomestead properties have an assessment cap of 10. Tula rashi in english 2021. Typically this means that people will pay an average of about 11232 per year just on their property taxes.

Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863. Whether you are presently living here just considering moving to Nassau County or planning on investing in its property study how district real estate taxes function. According to the county taxes will rise for 52 of homeowners and decline for 48.

The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. How much are taxes in Nassau County. What is feign retryableexception Search jobs.

Nassau County collects on average 179 of a propertys assessed fair market value as property tax. The 2021 Nassau County property tax rate was 515 per 1000 of full market value plus municipal tax rates for towns andor villages school district taxes and taxes for special districts. The Nassau County NY Traffic and Parking Violations Agency TPVA is now accepting payments of parking tickets online Nassau County Executive Thomas R.

Assessment Challenge Forms Instructions. They will use these values to help determine their tax rate for the property owners of Nassau County later this summer. More than 39000 homeowners will see increases of more than 3000 while 11000 will see increases of 5000 or more.

Tax Grievance Deadline 2023 Nassau Ny Heller Consultants

All The Nassau County Property Tax Exemptions You Should Know About

Signs Of Economic Vitality Abound In Nassau County Amelia Island Living

Understanding Your Nassau County Assessment Disclosure Notice

Nassau County Property Tax Reduction Tax Grievance Long Island

2022 Best Places To Buy A House In Nassau County Ny Niche

Nassau County Ny Property Tax Search And Records Propertyshark

Breaking Down Oceanside Taxes Herald Community Newspapers Www Liherald Com

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Property Taxes In Nassau County Suffolk County

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Long Island Property Tax Reduction Savings Suffolk Nassau Counties Tax Reduction Services

Nassau County Ny Property Tax Search And Records Propertyshark

Nassau County Reassessment Prompts Barrage Of Political Mailers Newsday